Is a gold rush coming much like in 2000 and have gold bears got it wrong this time around, Here is an interesting take from our partners at the The

WallStreet Window:

Proof that the Gold Bears are Wrong – Mike Swanson

I am bullish on gold and I own gold and mining stocks, because gold is in a bull market. I have been trying to do my best to tell people this, but many people simply do not believe it. Gold and the mining stocks went through a very brutal bear market for five years and that makes it hard for people to believe that any of the rallies are real.

What is more there are several “experts” that keep calling for gold to fall to $1,000 or even $250 an ounce that are scaring people out of gold. If you read this post you will see why these gold bears are wrong and know the one thing you need to know now that proves that gold is in a new bull market.

Then you will know that you do not have to be afraid and that you can take action. This is why people are looking at it.

What people are seeing is a rally up to $1,300 in gold this year and a pullback of that level happening right now.That pullback is making gold bears call for a crash again and scaring people out of gold and I know because I am getting lots of emails from people scared or trying to jump out of mining stocks in hopes of buying in at a much lower price.

This rally in gold has brought an over 100% gain for most mining stocks and has made the mining stock sector the best performing sector in the entire stock market

so far this year. Those in mining stocks this year are killing the stock market. And yet people are scared of a giant gold drop. Here is what I see:

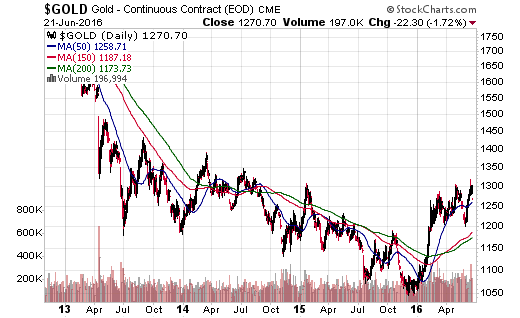

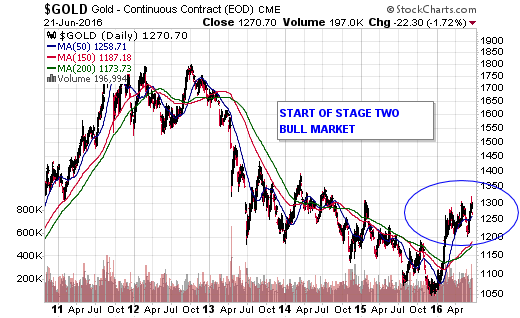

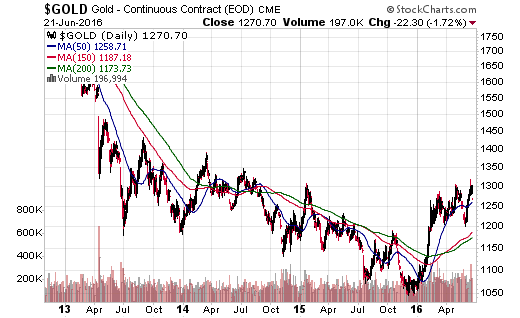

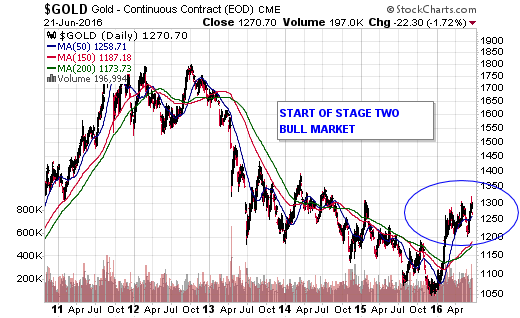

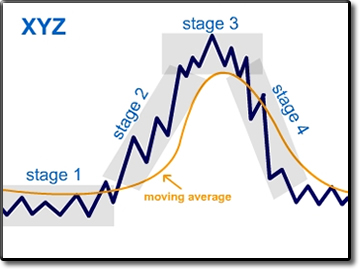

When you step back and look at the big picture of gold it is obvious that gold was in a bear market for a few years. You know that, but what is important is that during bear markets the 150 and 200-day moving averages slope down and act as resistance. But in January gold smashed through these moving averages and now those moving averages are turning up to act as support. I use classic stage analysis to identify whether a market is in a bull or bear market and it is obvious that gold is in a bull market now:

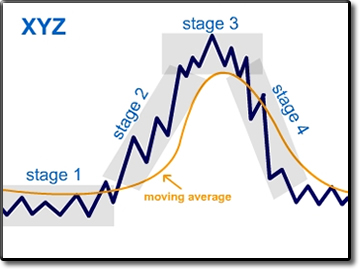

There are four stages to a financial market cycle in a stock or an entire financial market. As you know you can have a bull market. Before a bull market starts though you usually have a stage one basing phase in which a market simply goes sideways and builds a base. Then it breaks out and begins a full blown stage two bull market that typically lasts for several years. Then there is a stage three topping phase and then a stage four bear market.

There are various technical indicators you can use to determine when these stages are coming to an end so you can make the proper adjustments. That's a topic a little too big to get into now, but we can look at the basics right now. I can quickly show you one important indicator to watch to identify the trend the market is in. That's the long-term 150-day moving average, which is simply a line plotted on a chart using the average price number of the past 150-days.

In a bull market this line slopes up on a chart and the price of the market tends to stay above it, so it acts as a nice price support level in a bull market to make for a good entry point timing mechanism.

In a bear market this line slopes down on a chart and the price of the market tends to stay below it and it acts as resistance. So you can use this moving average to quickly identify the trend of a market. Then you can know if you should be bullish on a market or not.

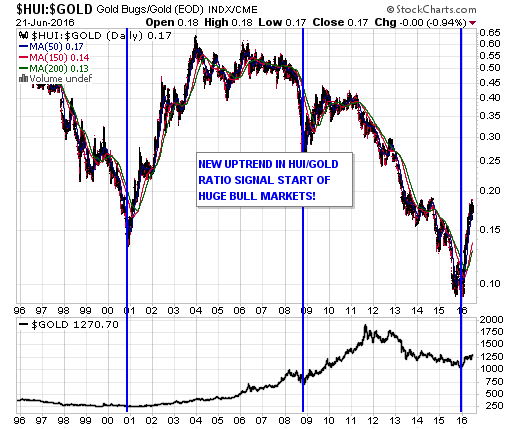

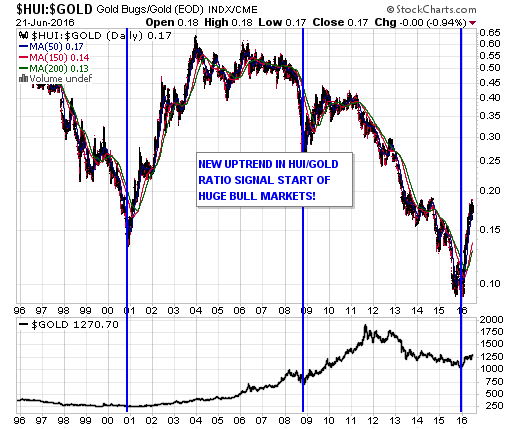

Of course I have been pointing this out for the past several months and it has not stopped the gold bears from predicting more gold crashes and has not stopped people from trying to jump in and out of gold every time there is a little weakness so let me show you one more thing that is even more important. There is a huge powerful trend that happens in gold bull markets and that is that the mining stocks tend to lead the price of gold higher.

In bear markets the opposite happens. When there is a gold bear market the mining stocks tend to fall much more than the price of gold does. At big tops in gold and silver the mining stocks often stop going up. So when silver prices made a final top in 2011 the mining stocks simply sat there as silver went higher.

And now this year the mining stocks are leading gold up. When gold has a temporary pullback they just come off their highs a little bit and then go up more. Now you can chart out whether the mining stocks are doing better than gold or worse by using the simple HUI divided by the price of gold ratio.

Take a look at it:

As you can see the mining stocks lagged gold for years and a few months ago just started a new huge powerful trend of leading gold higher and outperforming gold.This is a huge predictor of gains to come for both mining stocks and gold and proves that the gold bears are simply wrong and mistaken.

For more on this visit our partner Michael Swanson on his website www.wallstreetwindow.com.